Philippine tax laws and regulations are constantly changing and evolving. In particular, the TRAIN and CREATE Laws passed by Congress during the previous five years have fundamentally altered how taxpayers and accountants adhere to the Bureau of Internal Revenue's (BIR) already strict regulations. Due to this, the following changes should be anticipated in the coming year 2023 based on the TRAIN Law, CREATE Law, and recent relevant BIR issuances.

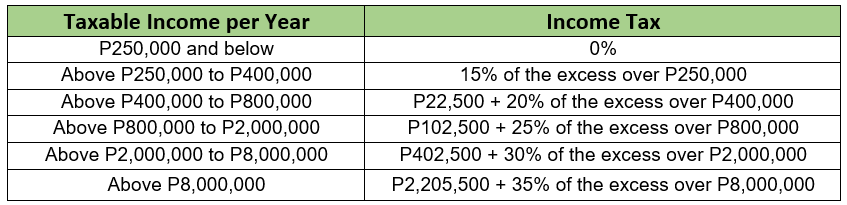

Under the TRAIN law, from the year 2023 onwards, the income tax for individuals will be reduced using this new tax bracket:

This change will not only directly affect individuals but also employers in computing the withholding tax on compensation of their Employees

It is good to note that last May 25, 2022, the Department of Finance (DOF) recommended deferring this scheduled reduction on their presentation for the “Fiscal Consolidation and Resource Mobilization Plan”. There’s still no update as of the time of writing.

The MCIT rate was temporarily lowered by CREATE Law from 2% to 1%. The CREATE Law, however, stipulated that it would only be valid through June 30, 2023. Effectively, the MCIT rate in 2023 will be 1.5 percent.

According to the TRAIN law, beginning January 1, 2023, the filing and payment of VAT returns shall be done within twenty-five (25) days following the close of each taxable quarter. Hence, starting January 1, 2023, VAT-registered taxpayers will no longer file monthly VAT returns and consequently not be required to pay the related VAT due.

As of the time of writing, the BIR has yet to provide guidelines and procedures for VAT-registered taxpayers.

TRAIN Law has required taxpayers in e-commerce, large taxpayers, and exporters to electronically issue their invoices or receipts, as well as report their sales data to the BIR at the point of sale on or before January 1, 2023. Last June 30, 2022, BIR provided policies and guidelines for the implementation of the use of EIS, BIR initially chose 100 large taxpayers for the pilot phase of the e-invoicing, e-receipting, and e-sales system, but only 15 of them have answered.

Per RMO 43-2022, the “Ask For Receipt” of existing registered taxpayers shall only be valid until June 30, 2023, due to the new Notice to Issue Invoice/Receipt (NIRI). Existing registered taxpayers are also further advised to update their registration to include a registered email address with the purpose of serving as one of the communications gateways for BIR and taxpayers.

For persons exempt from Value-added tax (VAT), CREATE law also reduced the rate from 3% to 1% until June 30, 2023.

Cityland Pasong Tamo Tower,

2210 Chino Roces Ave.,Makati City

1231

Philippines

+639279453382

Copyright © 2022 Babylon2k. All Rights Reserved.