Description:

When cryptocurrencies and digital services are a trend, is the Philippine government ready to address the growing need to accommodate it?Keywords:

digital economy, digital market, digital currency, tax compliance, cryptocurrency, blockchains, NFTs, tax philippines, BIRAs it goes, digital is the way of the future.

The Philippine digital market experienced a boom once everything shifted online. According to the Singaporean economic consultancy firm, “AlphaBeta,” the country can generate up to five trillion through digital transformation by 2030, if leveraged wisely.

So, where are we when it comes to digitalization?

It’s this immutable ledger of decentralized data, securely shared with anyone, used to exchange cryptocurrency. It is said to greatly shake the financial service industry, legal industry and even politics.

As cryptocurrency grows, more crypto exchange platforms are expected to emerge. There are currently 48 registered cryptocurrency exchanges; 37 from the Cagayan Economic Zone Authority (CEZA) and 19 from the Bangko Sentral ng Pilipinas (BSP). Currently, CEZA is building the “Crypto Valley of Asia” in collaboration with Northern Star Gaming and Resorts Inc.

Play-to-earn games like Axie Infinity, Age of Rust, and Illuvium are a widely-popular avenue for crypto. Non-fungible tokens (NFTs), which are unique cryptographic tokens, are traded in games and digital arts.

Filipinos spend the most time online. Ergo, digital services are consumed every day. Services from Google, Netflix and YouTube are just some popular examples availed by the Filipinos.

There are currently no specific accounting standards for the crypto market.

However, using the Philippine Accounting Standards (PAS) 38 as a guideline, accountants and auditors recognize digital assets as Intangible Assets. This could change depending on the terms and conditions of why a virtual asset is held by a taxpayer.

Thus, it is necessary to recognize these terms:

Digital currency can be recognized as cash once it becomes “fiat” currency or an accepted medium of exchange.

If the digital currency meets the definition of a financial instrument according to Philippine Financial Reporting Standards (PFRS) 9, financial assets are considered valid and represent “cash.”

Intangible assets are defined as an identifiable non-monetary asset with no physical substance. Virtual assets are widely recognized under PAS 38.

Revenue recognition for digital gaming and subscription services can be complicated.

The company needs to be determined if it possesses any internally generated intangible assets. It also needs to determine if it is the principal or the agent to the transactions, which will affect its recognition pursuant to PFRS 15.

The Department of Finance (DOF) proposed to clarify the tax treatments of virtual currencies by 2024.

Currently, the Bureau of Internal Revenue (BIR) encourages taxpayers to report their income from these digital assets DOF Undersecretary Antonette Tionko, said that cryptocurrency is an asset, making it subject to income tax. “Whoever earns currency from it, it’s income. You should report it.”

It’s currently unlikely that cryptocurrency will be treated as “fiat” in the Philippines. A deeper understanding is required to define the rules for taxing cryptocurrency. For now, taxation shall be when it is converted to “fiat” currency.

Income payments by local companies to non-resident foreign corporations (NRFC) are assessed by the Bureau of Internal Revenue (BIR) for deficiency taxes; particularly on tech giants due to alleged non-withholding of final tax.

Those who act as the withholding agents are held responsible for their failure to withhold taxes from NRFCs. However, it is difficult to implement these as NRFCs are operating through digital platforms. These payments are subject to 25% final withholding tax and 12% final withholding value-added tax.

To compensate the additional taxes, local companies and NRFCs may apply for tax treaty benefits, which guidelines are streamlined by RMO 14-2021.

Of course, taxpayers who attempt to evade any filing of tax returns or tax payments are criminally liable under Sections 254 and 255, in relation to Section 248(8) of the NIRC:

- Punishable by a fine of five-hundred thousand (₱500,000) to ten million (₱l0,000,000) and suffer imprisonment of six to ten years; provided, that the conviction or acquittal obtained shall not be a bar to the filing of a civil suit for the collection of taxes.

Punishable by a fine of not less than ten thousand (₱10,000) and suffer imprisonment of one year to ten years.

Necessary tax compliance must be practiced to avoid being liable for tax evasion, civil penalty of 50% of the tax or of the deficiency tax.

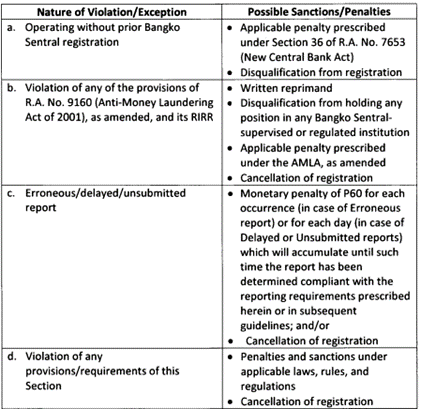

VASPs are regulated by the BSP through Circular No. 944 and further amended by Circular No. 1108. Sanctions are enumerated below:

The SEC is drafting rules for virtual currency exchanges. As mentioned by former SEC Commissioner Ephyro Amatong, “We want to create an environment where investors can feel (…) safe in investing in (...) securities that have a digital form.”

Companies engaging in digital services and virtual currency exchanges are expected to comply with the Revised Securities Regulation Code (SRC) Rule 68. The SEC warns individuals or groups representing crypto-investing of the required compliances.

It is imperative to learn about the various compliances following digital transactions. Thus, taxpayers must be armed with relevant knowledge to guidelines and procedures. Otherwise, they may consider seeking assistance from professionals in the field.

Cityland Pasong Tamo Tower,

2210 Chino Roces Ave.,Makati City

1231

Philippines

+639279453382

Copyright © 2022 Babylon2k. All Rights Reserved.