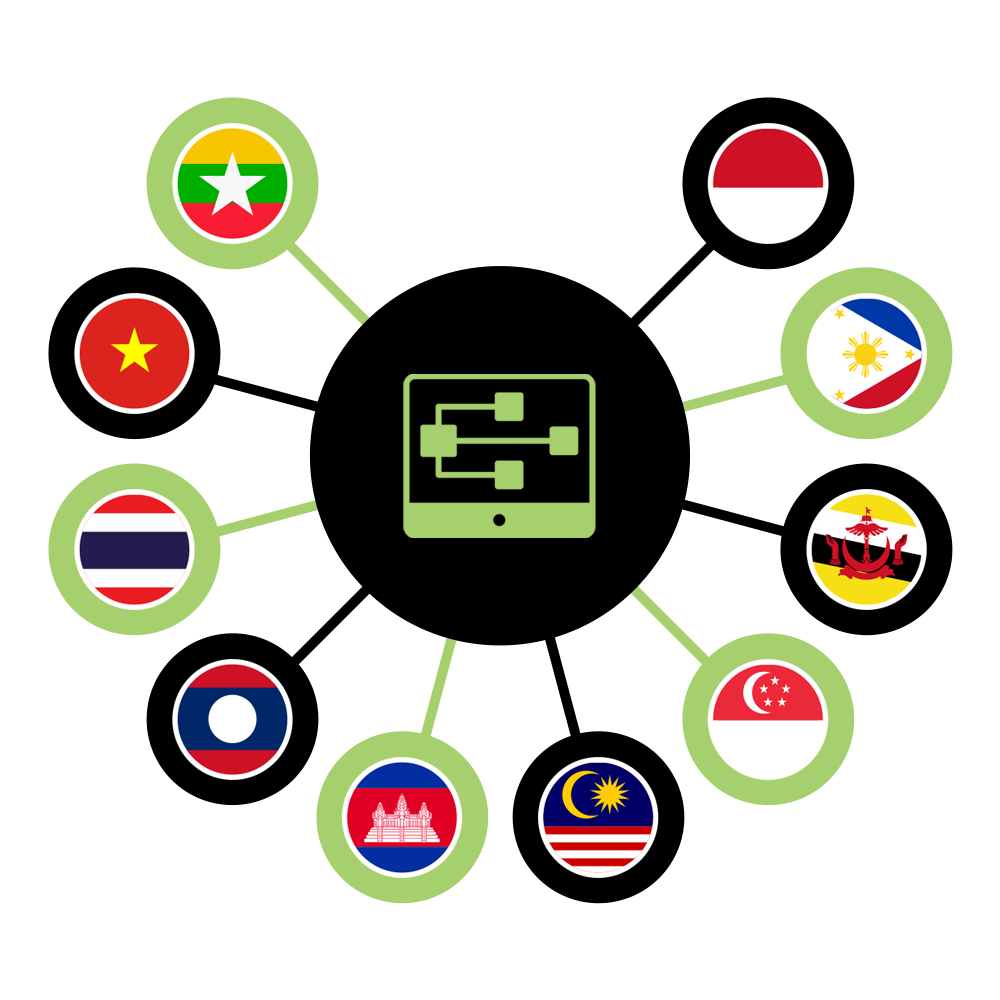

Loosely defined, 'cross-border accounting transactions' refer to the movement of financial resources between different countries or regions, such as money or assets. In Southeast Asia, cross-border transactions are becoming increasingly common as businesses expand their operations beyond their domestic borders.

While technological innovations such as blockchain and e-commerce continue to propel business progress worldwide, cross-border transactions can present several challenges for accounting professionals.

One of the most frequent dilemmas is navigating different cultural, legal, and regulatory frameworks to record and report these transactions accurately.

The art of international tax

One of the main challenges of cross-border accounting in Southeast Asia is the diverse range of accounting standards and practices across the region.

For example, some countries in the region follow International Financial Reporting Standards (IFRS), while others follow Generally Accepted Accounting Principles (GAAP) or local accounting standards. These legal variations can make it difficult for businesses to report their financial results accurately and for investors to compare the financial performance of different companies.

As a country with a rapidly growing economy, the Philippines has many laws and regulations to govern cross-border tax transactions. The Bureau of Internal Revenue (BIR), the government agency responsible for collecting taxes in the Philippines, enforces these laws.

One of the primary laws related to cross-border tax transactions in the Philippines is the National Internal Revenue Code (NIRC). The NIRC contains provisions pertaining to the taxation of foreign businesses operating in the Philippines and the taxation of Philippine companies conducting transactions with foreign entities.

Under the NIRC, foreign businesses operating in the Philippines are subject to corporate income tax on their Philippine-sourced income. This provision includes revenue from the sale of goods and services in the Philippines and income from the use of property or assets located in the Philippines. Foreign businesses must register with the BIR and obtain a tax identification number (TIN) to be eligible to pay corporate income tax.

A case study

Let's say a Philippine company provides IT and consulting services to international organizations. Its accountants claim that the Company is not subject to VAT (value-added tax) because they are considered zero-rated sales.

However, the BIR has rejected this claim and said that the Company must pay VAT because they cannot prove that the services were provided to a nonresident who is not conducting business in the Philippines.

Additionally, the Company's zero-rated sales to its parent company (which is also based abroad) are also not allowed because the parent company owns 99% of the Company, meaning that it is considered to be conducting business in the Philippines.

To overcome these challenges, accounting professionals must have a thorough understanding of the accounting and tax systems in the countries in which they operate. They must also be able to work closely with tax and legal advisors to ensure that they comply with all relevant laws and regulations.

Doing cross-border taxation right

Other tax challenges in cross-border transactions may concern different regional tax regimes. Some countries have high corporate tax rates, while others have more favorable business tax regimes. These differences in implementation can make it difficult for businesses to plan for and manage their tax liabilities when operating in multiple countries.

In addition to corporate income tax, foreign businesses may also be subject to value-added tax (VAT) on their sales in the Philippines. VAT is a tax on the sale of goods and services in the Philippines and is generally imposed at 12%.

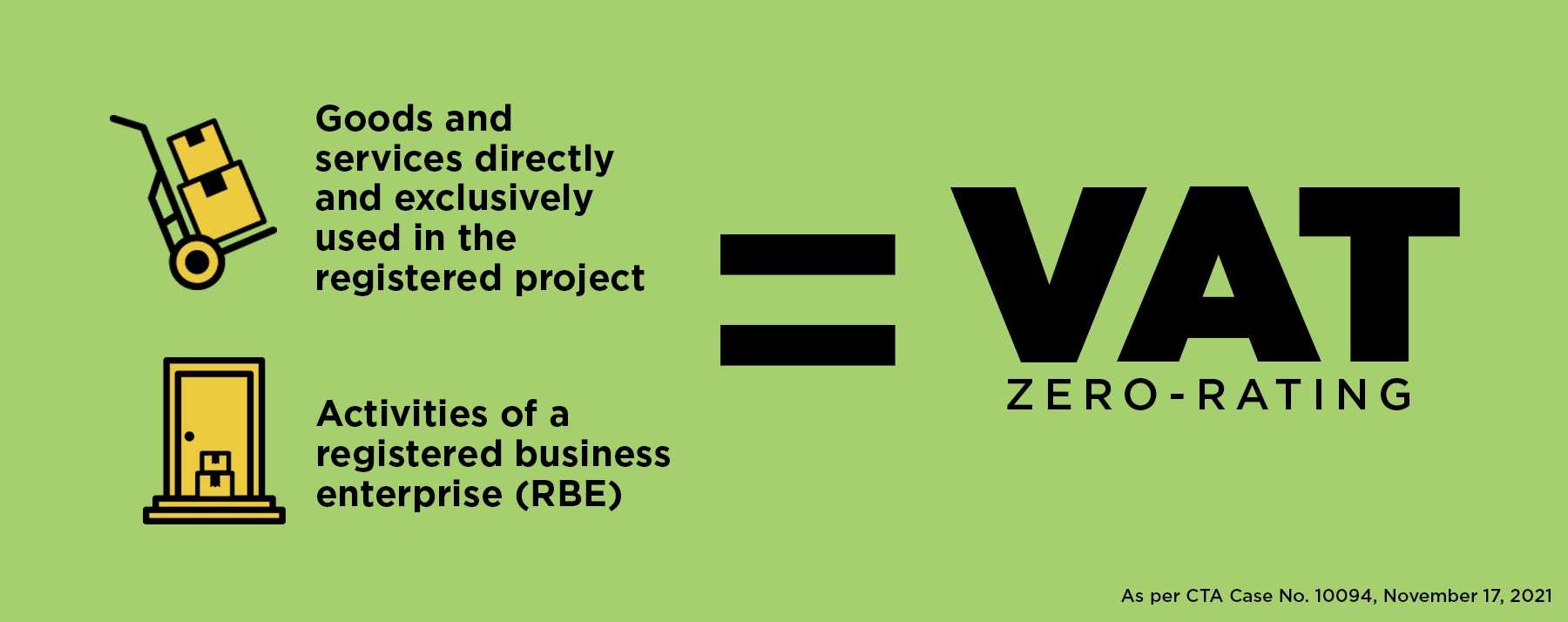

However, certain transactions are considered "zero-rated" and are not subject to VAT, such as exports and the sale of goods or services to foreign entities not engaged in business in the Philippines.

In our first example, the Company must have all necessary documentation to demonstrate that its sales of services qualify for zero-rated value-added tax (VAT).

According to a ruling by the Court of Tax Appeals (as per CTA Case No. 10094, November 17, 2021), a sale or supply of services must meet the following requirements to be eligible for a VAT zero-rating:

The services fall under any of the categories under Section 108 (B) (2), or the services rendered should be other than "processing, manufacturing or repacking goods";

The service must be performed in the Philippines by a VAT-registered person;

The payment for such services should be in acceptable foreign currency accounted for per BSP rules;

The recipient of the services is a foreign corporation, and the corporation is doing business outside the Philippines or is a nonresident person not engaged in business who was outside the Philippines when the services were performed.

Now, let's say the Company complied with items one and two.

However, the following documents are not available to support provisions under items three and four.

With that (and as per CTA EB Case No.1932, September 3, 2020), the Company should secure the following:

Certificate of Inward Remittance issued by the Bank, which includes the remitting bank, the gross and net proceeds, the currency of the proceeds, and other essential details.

Article of Incorporation/ Memorandum of the Nonresident Foreign Customer to prove that the nonresident corporation is indeed registered outside of the Philippines.

SEC Certificate of Non-registration, as ruled in various CTA Cases, which is sufficient to prove that the foreign corporation is doing business outside of the Philippines.

As to the sales transactions to its Parent Company, under the definition of 'doing business in the Philippines', it is also important to note that all inclusions are covered by the provisions under Section 3 (d) of Republic Act No. 7042.

This provision applies unless the phrase 'doing business' shall not be deemed to include mere investments as a shareholder by a foreign entity in domestic corporations duly registered to do business, as well as the exercise of rights of such investor.

Likewise, it does not apply to those with a nominee director or officer to represent its interests in such a corporation, nor appointing a representative or distributor domiciled in the Philippines which transacts business in its name and for its own account.

The bottomline

Overall, cross-border accounting transactions in Southeast Asia can be complex and challenging. Still, with the proper knowledge, consultants, and tools, businesses can successfully navigate these challenges and expand their regional operations.

The BIR plays a crucial role in enforcing the Philippines' cross-border tax laws and ensuring that businesses in the country comply with all relevant regulations. By understanding and complying with these laws, companies can ensure that they operate transparently and fairly to avoid potential legal and financial consequences.

###

About Mhike:Michael 'Mhike' L. Aguirre has managed the accounting firm UHY M.L. Aguirre & Co., CPAs, since its inception in November 2006, and BABYLON2K.org, launched in 2021. He received his Master in Business Administration (MBA) from the Ateneo Graduate School of Business in 2006 and his Masters of Science in Taxation (with International Taxation as his Certification Program) at Golden Gate University, San Francisco, CA, USA, in 2019.

Mhike's career has led him to spearhead projects in foreign-funded projects and NGO operations in Vietnam, Laos, and Cambodia. He also performed numerous statutory and special audits on local and foreign corporations, consultancy engagements involving mergers and acquisitions (M&As), consolidations, receiverships, and rehabilitations.

He continued his audit practice in Manila in 2001 until he launched his own firm. Under his leadership, the firm has grown from an individual practice into a partnership that caters to multinationals, export-oriented companies, online gaming, "fintech," other digital intermediaries, and small and medium-sized enterprises.

Mhike also served as a faculty member of the University of Makati from 2009 to 2010, as a committee member for the Philippine Institute of Certified Public Accountants in 2015, and as the Committee Chair for Ethics and Governance of the Association of CPAs in Public Practice in 2016.

Cityland Pasong Tamo Tower,

2210 Chino Roces Ave.,Makati City

1231

Philippines

+639279453382

Copyright © 2022 Babylon2k. All Rights Reserved.